According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. TCJA and the 10000 SALT Cap.

Salt Deduction Resources Committee For A Responsible Federal Budget

That limit applies to all the state and local.

. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform framework released by. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018.

Section 164 of the Internal Revenue Code IRC generally allows a deduction for state and local taxes paid. However many filers dont know. Capping the deduction in 2017 reduced the benefit for people who.

Effective for tax years 2021-2025 the Small Business Relief Act. However for individual taxpayers who itemize their deductions the Tax Cuts and Jobs Act TCJA introduced a 10000 limit on state and local taxes paid that an individual can deduct during the year 5000 for married individuals filing. Unfortunately especially for higher income households the SALT deduction has been capped at 10000.

Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. California Enacts SALT Workaround.

The deduction also incentivized states to tax their residents more progressively since the SALT deduction applies to types of taxes that tend to be progressive like taxes on income. The SALT deduction cap included in the 2017 federal tax overhaul indirectly expanded a long-running loophole benefiting private K-12 schools. State and Local Tax SALT tax deduction cap explained.

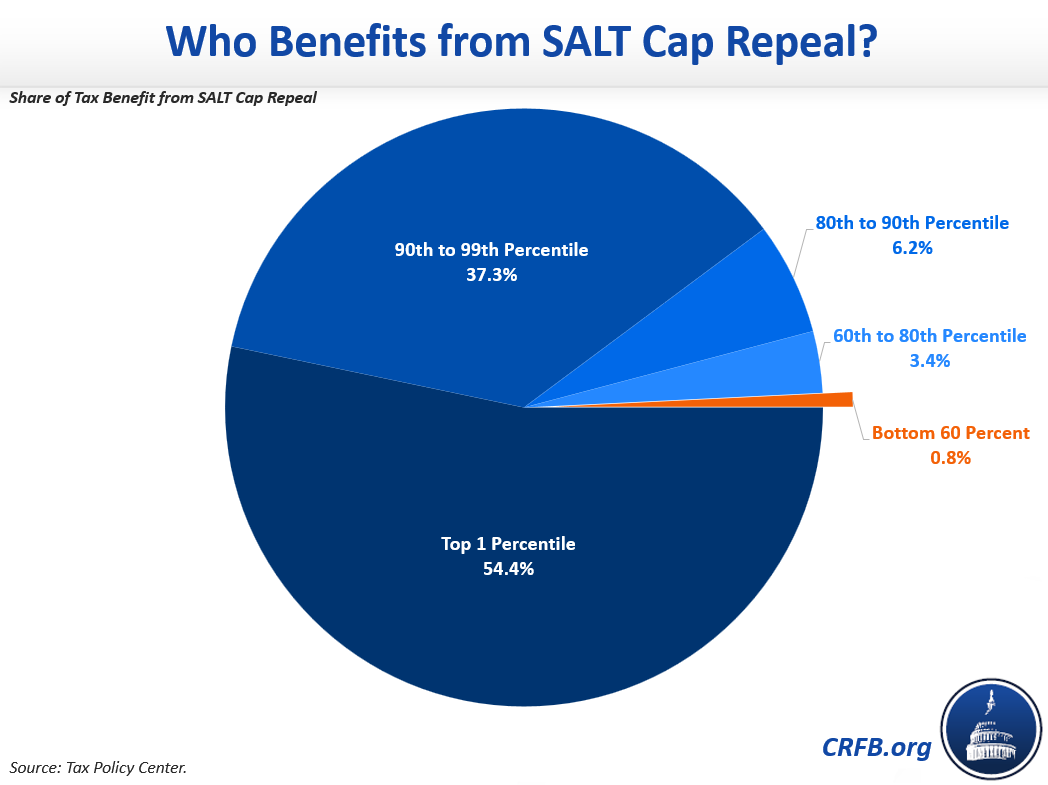

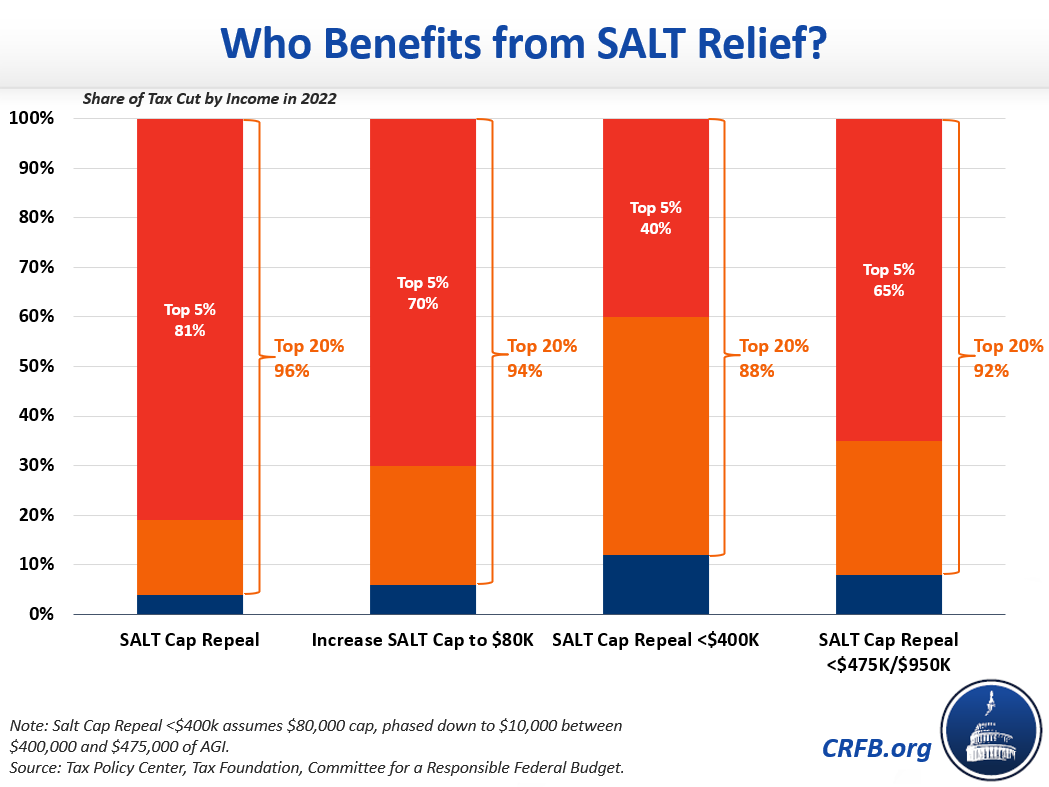

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. 53 rows The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly.

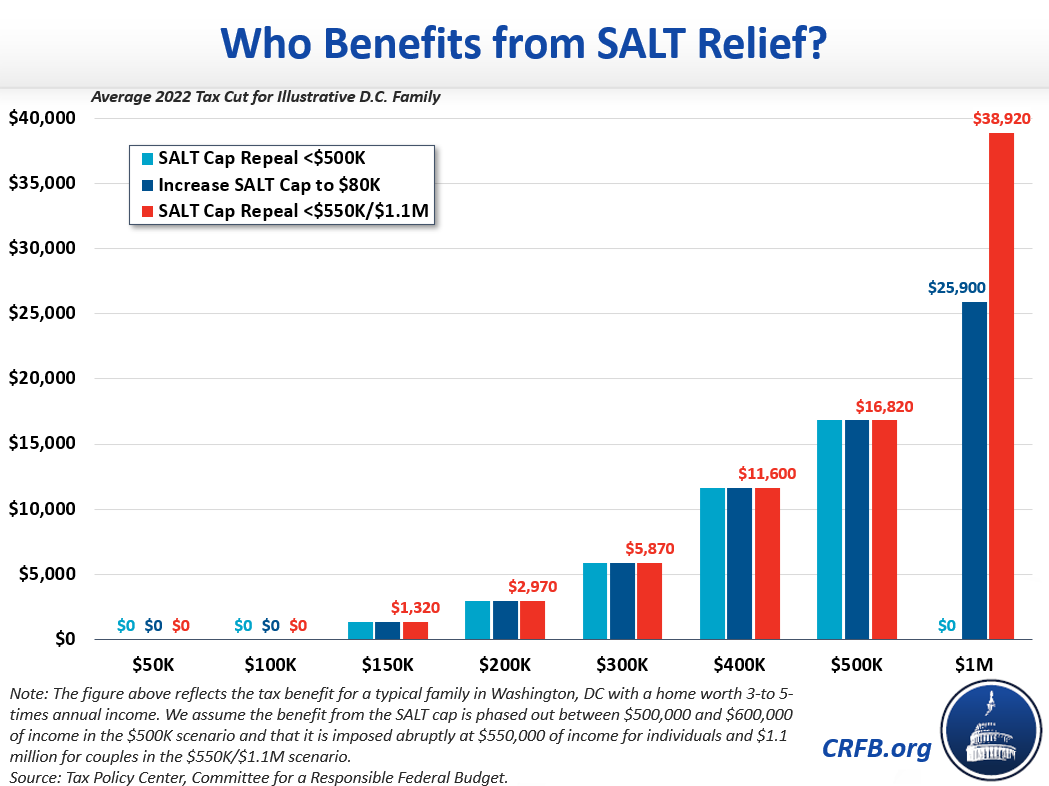

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. The federal tax reform law passed on Dec.

For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. 52 rows The state and local tax deduction commonly called the SALT. The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net cost of nonfederal taxes to those who pay them.

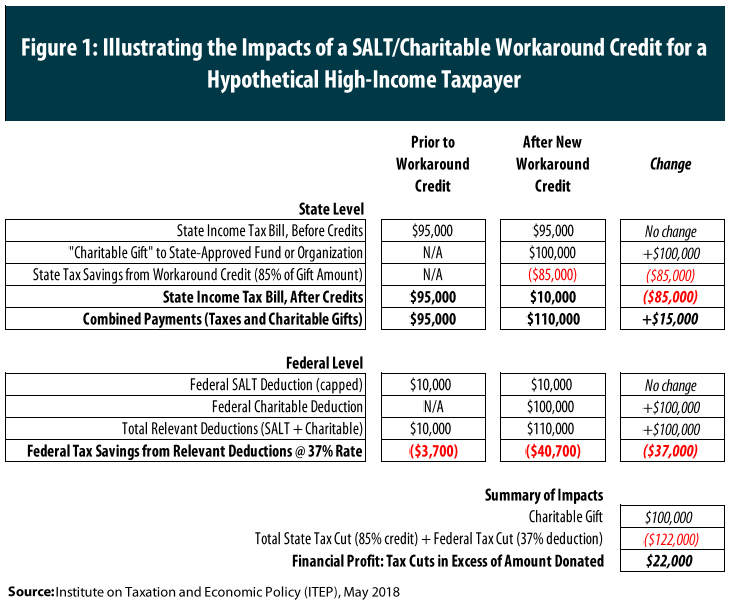

This report written shortly before the bills final enactment explains how the tax shelter operates and how the new federal tax law expanded its size and scope. The SALT deduction has been a part of tax policy since before the federal income tax was created in 1913 and apart from some minor changes in. 11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct.

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades. The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

Deductible taxes include state and. Theoretically state and local governments could then use. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize. The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Deduction Resources Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Deduction Resources Committee For A Responsible Federal Budget

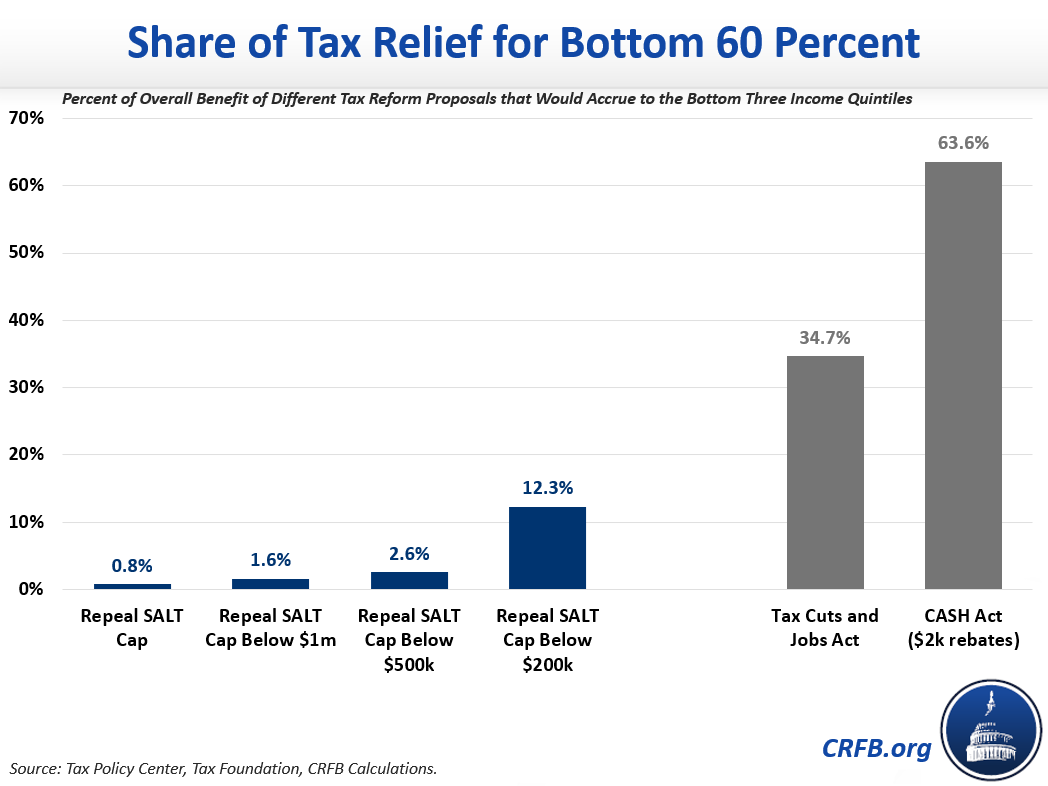

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It